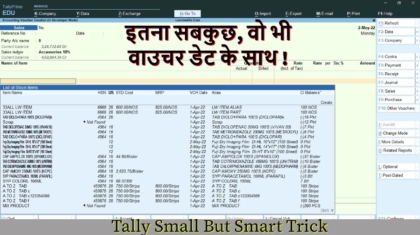

2022 Free Item complete details TDL for Tally Prime | Best free new Tally TDL to see Item All details | Item All in One details TDL

With the help of this fantastic item complete details TDL, we can see and export an item's whole detail list. I thus gave it the name Item All in One details TDL. We can extract every item information, including godown and opening balance, using thi ...

Cart is empty

Cart is empty