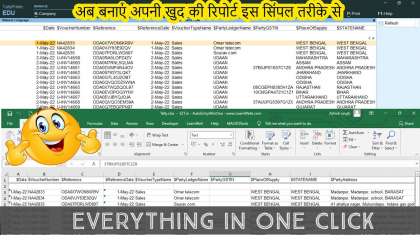

Best way to Merge Files in to One with Power Query for Excel | Combined Multiple files in One with Excel Power BI

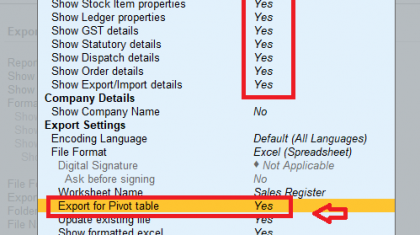

If you’re using Excel and you’re not using Power Query, you’re missing out! Power Query is a game-changing data transformation and manipulation tool that’s work perfect in all latest Excel versions. With Power Query for Excel, you can easily conn ...

Cart is empty

Cart is empty