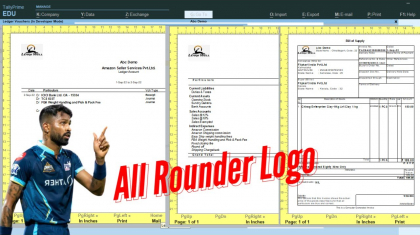

2023 Best Logo TDL for Tally | Add Logo Everywhere in Tally

Today I have best logo TDL for Tally, that can change your company value and authenticity. In today's digital age, creating a strong brand identity and standing out in the market is more important than ever. One key aspect of building a successful b ...

Cart is empty

Cart is empty